At BENFO – The Benevolence Foundation, we make it simple and rewarding to turn your high-value asset—such as a yacht, airplane, or motor home—into life-saving support for children battling serious illness. Here’s how our process works, step by step:

Before making your donation, the IRS requires an independent appraisal of any non-cash charitable gift over $5,000. This helps determine the fair market value for your tax deduction and protects both you and the charity.

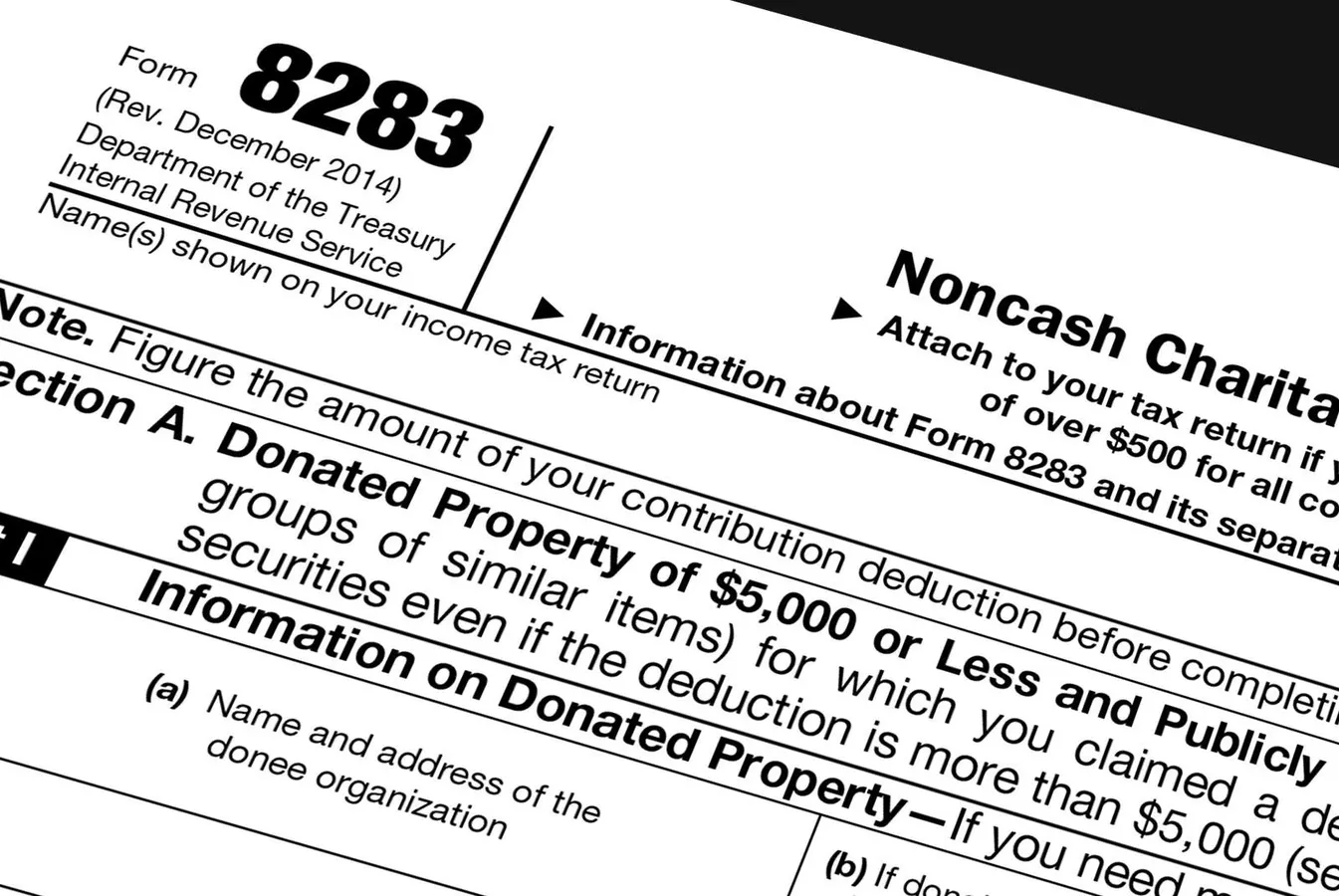

This step ensures IRS compliance and sets the foundation for your charitable deduction under IRS Form 8283 and Section 170(f)(11) of the Internal Revenue Code.

After the appraisal, we guide you through a smooth and secure transfer of ownership. Whether your asset is a vessel, aircraft, vehicle, or luxury item, our team will help you handle all legal and logistical requirements.

This letter is essential for claiming your charitable deduction on your federal tax return.

Once the donation is complete, BENFO takes care of everything else. We work with trusted brokers, auction houses, and industry professionals to market and sell your asset for maximum value.

This means less hassle for you and more support for the families who need it most.

After the asset is sold, you’ll receive the final documentation required for your tax records, including the sale amount (if applicable) and IRS Form 1098-C when relevant.

Your gift is more than a tax benefit—it’s a powerful act of kindness that helps children and families find hope during the hardest times of their lives.